In a new children’s book, A Kid’s Guide to Money (Brainologi), by educators Shubhada Dayal, Sheetal Kapoor, and Radhakrishnan Pillai, 10 students from a school engage in various activities that involve saving and spending money. Young readers are equipped with 10 cool lessons that connect them back to teachings from one of the oldest books on economics and financial strategies, Chanakya’s Arthashastra.

Dayal tells us, “An early understanding of money can significantly influence financial outcomes later in life. Besides, there are so many areas, such as restaurants, packaged food, or toys, where children exert consumerist pressure. This makes them significant participants in the household finances, holding considerable purchasing decisions.” Additionally, access to smart devices can make them vulnerable to financial crimes. To this, Kapoor adds, “I have encountered many parents who feel that today’s kids are used to better amenities without understanding where money comes from.” These concerns led to the genesis of the book.

The magic of small paisa

Here’s a sneak-peek into five ideas we loved:

1 Value matters: All things have value. This is one of the earliest lessons that children are taught in the book. Something may be more valuable to you than to another person. When one pays for something, therefore, one is paying for their value. Before buying it, it’s crucial to assess if the object is going to be useful to us.

2 The magic of small paisa: Children dive into the habit of saving small portions of money regularly and learn of its benefits in the long run. When Chanakya was writing his treatise, he noted this as a great strategy for rulers, so they could be prepared for handling emergencies, like floods and wars.

3 Two sides of borrowing: Young readers also understand when and how to effectively borrow. They’re introduced to the idea of loans and the importance of returning a loan. When a character in the book loses a borrowed object, he learns that one must avoid borrowing for frivolous purposes.

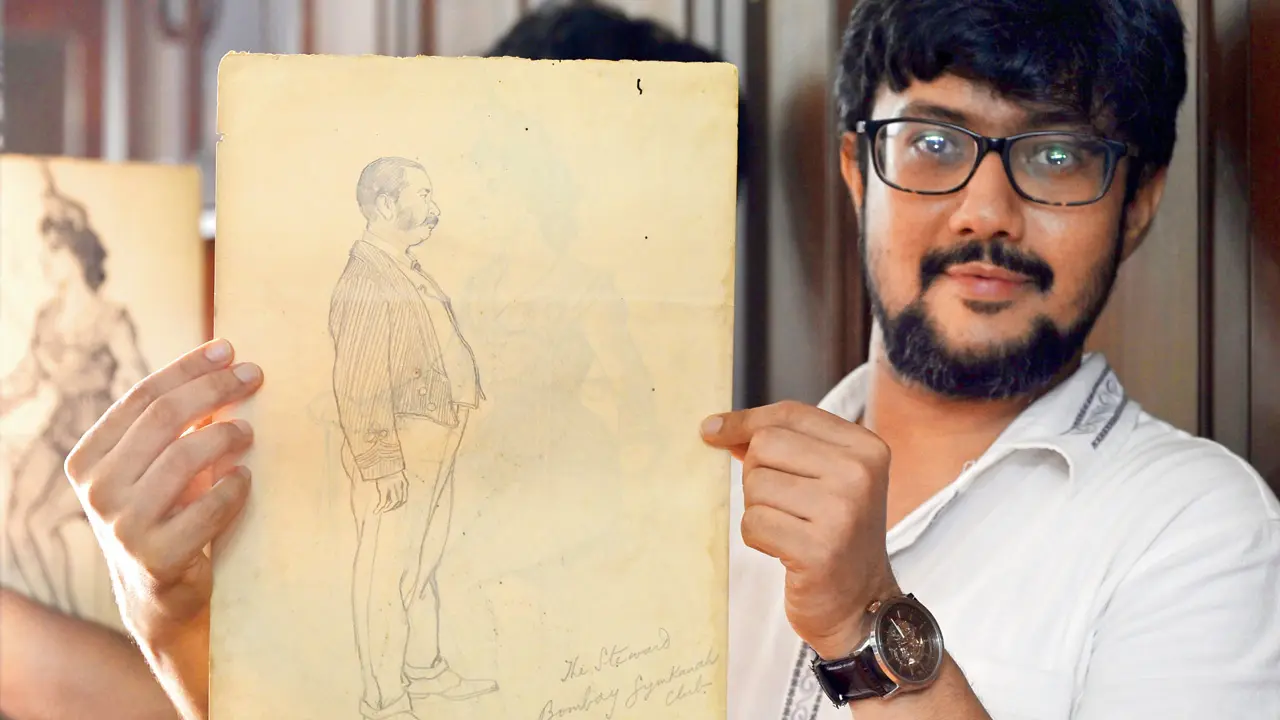

Sheetal Kapoor and Shubhada Dayal; Radhakrishnan Pillai. Pics Courtesy/Brainologi

4 Risk management: The authors also introduce the concept of insurance to children through a cool club formed by some students to help each other out during a financial crisis. This familiarises them with the idea of accounting for risks, such as fires or accidents, so that they understand how this helps reduce the loss incurred from such setbacks.

5 Protect your money: Don’t trust new schemes too easily, young readers. The authors warn their readers that it’s better to be cautious and prevent ourselves from being swindled than to try and recover the lost money later.

Available At leading bookstores and e-stores

Cost Rs 319